Solve all your financing problems with the Ally Banking app! If you want to invest, home loans, banking, and auto finance services from Ally open the door for you.

| You can enroll for a checking account with Ally Banking and get a $200 sign up bonus by using the Ally coupon code “GET200.” Ally also presents an exclusive Pilot Referral Program which gives you $50 for every person you refer. |

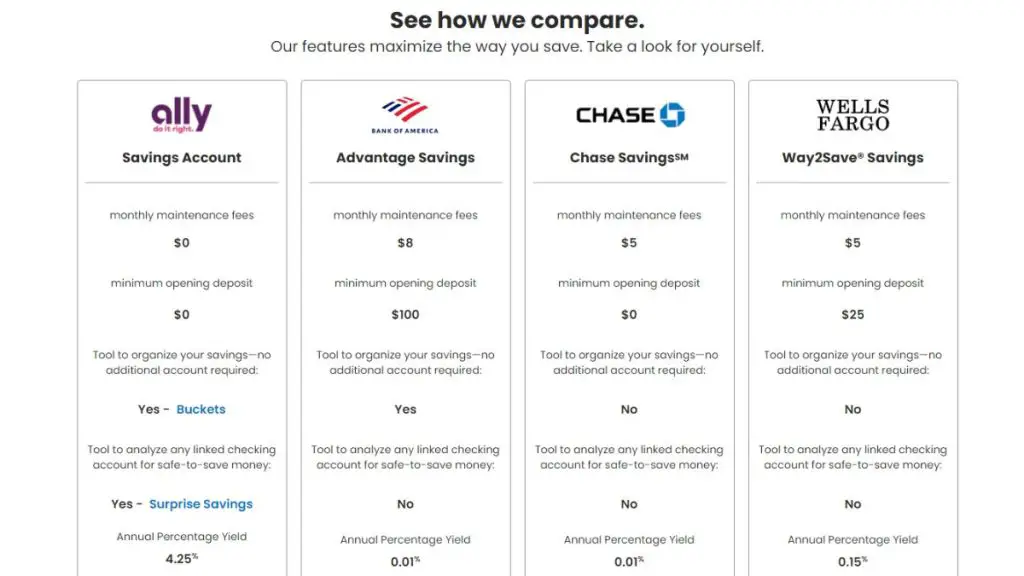

In the US, Ally Bank is another good-service online banking platform that offers lower rates at a competitive price with no minimum balance limit.

To sign up with it, you can earn a $200 Ally Sign Up Bonus and get an unlimited deal to earn a $50 Ally Referral Bonus from its Pilot Referral Program and referrers will also get a $100 bonus.

Below is the complete guide to claiming the Ally Sign Up Bonus, Ally Referral Bonus, Ally Pilot Referral Program and other necessary facts that you need to know before joining Ally Banking.

Ally Sign Up Bonus— Get $200 Checking Account Cash Bonus

Whenever you open a checking account with Ally Banking by using a “GET200” Ally coupon code, you will receive a $200 sign-up bonus within 30 days of opening an account.

But it requires completing the terms and conditions to earn the $200 Ally Sign Up Bonus. Here are the steps you could follow to get the bonus successfully:

How to claim a $200 Ally Checking Account Cash Bonus?

- Click it to create your account with Ally Banking. Fill in all the required fields.

- After signing up with a checking account, use the “GET200” coupon code.

- You have to receive a minimum direct deposit of $1,500 within 90 days of creating an account.

- As soon as your deposit is completed, you will receive your sign-up bonus within 30 days.

Attention: This offer has a time limit, so wake up and avail of this beneficial $200 sign up bonus offer NOW!

Ally Referral Bonus: Get $50, Give $100

Ally Bank makes its customers happy by developing the Ally Referral Program which gives you $50 for every qualified referral.

The person you referred also gets a $100 reward when they complete the requirements of the Ally Pilot Referral Program. Below is the step-by-step guide that mentions all the conditions to get the $50 Referral Bonus.

How to claim a $50 Ally Referral Bonus? (Pilot Referral Program)

- Join the Ally Pilot Referral Program.

- After signing up, copy your unique Ally Banking referral link.

- Share your Ally referral bonus link with your family and friends and other social media platforms.

- When you get clicks or your link is applied to open an account, you will receive a $50 referral bonus.

- But to qualify for it, the referee has to receive a direct deposit within 60 days of opening an account.

- After the requirements are met, you both will be rewarded with the referral bonus.

Latest Updates: Check high paying referral programs of Chase, Nav, Albert, and Step Banking.

Attention: Currently, Ally Bank is offering this Pilot Referral Program but remember that it can change terms & conditions or discontinue the program at any time.

About Ally Banking:

“Ally is one of the best-known digital banks in the US and features checking accounts, high-yield savings accounts, CDs, home loans, and investing offers. Further, it has competitive interest rates, charges low fees, and gives you personal banking advice.”

Ally Banking has no minimum balance requirements and gives you high-interest-bearing checking accounts at competitive rates.4.25% APY high-yield savings accounts, 4.40% APY money market accounts, and 5.00% APY highly rated CDs are confounding!

Ally Banking Products:

As a full-service banking app, it provides you with multiple accounts and other financial products:

- Checking Account.

- Saving Accounts.

- CDs.

- Money Market Account.

- Home Loans.

- Retirement Accounts.

- Investment Portfolios.

- Purchase Mortgage.

- Refinance Mortgage.

- Self-directed trading.

Ally Banking Features:

Ally is a digital online banking platform that is considered the top choice in the US as it includes many beneficial features.

No Banking Fees: Ally doesn’t charge monthly maintenance fees, overdraft fees, ACH transfer fees, or a low balance fee. To put it another way, Ally Banking does not let you pay any kind of fee.

High APY Rates: Ally Banking sets highly competitive APY rates for savings, checking, CDs, and money market accounts. With it, you can reach to your financial goals.

Ally Investing Options: Ally offers investing in US-based equities, mutual funds, ETFs, and fixed-income products. Moreover, it includes CDs and corporate, agency, municipal, and US Treasury bonds.

Customer Support: Ally customer service is available 24/7 to support you. You can communicate with them via chat, phone, email, or chat correspondence. You get your complaint instantly and a question to be answered after your application.

Is Ally Banking Save?

Yes, Ally banking is safe and legit; all your qualified accounts are FDIC insured with Ally. This insurance keeps your money secure up to the federally designated amount limit of $250,000.

Ally also respects your personal privacy by defending your SSL data encryption and multi-factor authentication through firewalls. Its system is always analysing your information, and if it finds any suspicious activity, it alerts you via text and email.

Conclusion:

Ally Banking can be your ideal bank as it provides high-interest savings, CDs, and checking accounts with minimal fees and a hard-working team for customer support. It works best for those who are looking to get an online-only bank for their finances and don’t want to access banking physically.

Besides all its heart-whelming features, it gets more customers due to its $200 welcome offer and limitless $50 referral bonus program. Now it’s time to get up! And claim all these offers before they are discontinued.