Sezzle Referrals Buy Now, Pay Later apps have increased significantly in recent years as a payment option. With buy now pay later apps, you can shop without affecting your credit card. If you don’t have the cash up front, it’s a great way to save money.

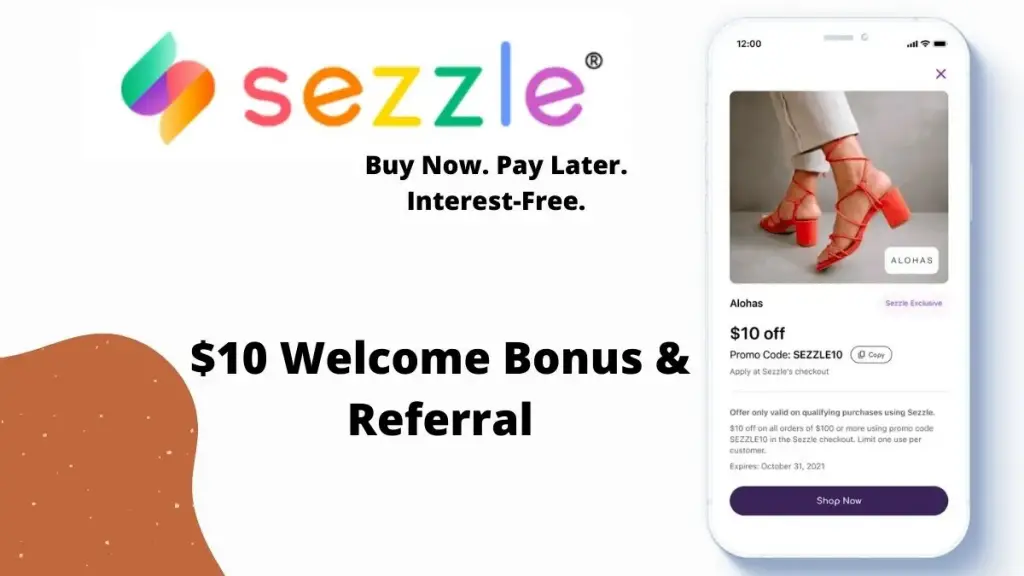

You can divide your installment into equal parts for six months with Sezzle, a popular buy now, pay later app. Participate in the Sezzle referral program and get a $10 Sezzle sign-up bonus.

Sezzle $10 Sign-up Bonus

Sezzle offers a $5 sign-up bonus if you use any referral link, but if you use our unique link, you’ll get a $10 bonus.

Sezzle $10 Sign Up Bonus Steps

- Sign Up for a Bonus Link for Sezzle

- Sign up for Sezzle by clicking the button above.

- Select your account type from “Merchant” or “Shopper.”

- Sign up using your phone number and primary information.

- Apply for a credit card now. There are two types of cards: virtual and physical.

- Through Sezzle, you can buy any product you want and pay in installments.

- You’re done! Your $10 sign-up Bonus will be credited to your account immediately.

$5 Referral Bonus for Sezzle Referrals

Referring new friends to Sezzle with your referral link and completing all the sign-up processes above will earn you a $5 bonus.

You can apply the referral bonus to your next offer. You’ll also get $10 off using this Sezzle referral code – SZDES!

What is the process for claiming a $5 referral bonus?

- Sign in to your Sezzle account.

- In the menu, search for the Sezzle refers to a friend option.

- Share your unique referral link with your family and friends.

- You’re done! Both of you will receive $5 Bonus rewards when they sign up.

Sezzle – What is it?

With Sezzle, you can buy now and pay later. Make 4 interest-free payments over 6 weeks when you shop online at any of our partner stores. This can save you a lot of money, especially if you don’t have the cash upfront.

Founded in 2016, Sezzle is a leader in the Buy Now Pay Later industry. With its headquarters in Minneapolis, it is a publicly traded financial company.

In September 2020, Sezzle launched the Sezzle Virtual Card, which customers can add to Apple Pay or Google Pay apps and use in-store.

Similar to Venmo and Strike, Sezzle offers payment services. After a party or shopping, you can split a transaction with your friends.

Sezzle’s only disadvantage is that it doesn’t offer cash back on shopping. Here are the best cash-back apps of 2022 that will give you a discount of up to 40% on your online shopping.

What is the legitimacy of Sezzle?

With Sezzle, you can split your payments into equal installments. If you’re considering a buy now, pay later plan, read the terms carefully.

Sezzle may be a good option for smaller online purchases if you can afford a 25% down payment and can pay off the balance within six weeks.

Credit card interest rates can be lower than what you’d pay if you paid three on-time installments.

Sezzle’s data security is top-notch. The company adheres to PCI compliance standards to protect your personal information and transactions.

The dangers of Sezzle, however, are similar to those of credit cards regarding your budget.

Sezzle can help you build your credit, one of its many benefits! Paying on time will increase your credit score, whereas missed payments may negatively impact it.

We will report your Sezzle payment history on your behalf as a Sezzle Up subscriber.

Make 4 interest-free payments over 6 weeks.

There’s no need to pay the total balance upfront if you can’t! You can make interest-free payments for up to six weeks, then pay your balance when it’s due. What if you need a little more time? The 0% purchase rate can be extended at any time.

Features of the Sezzle App

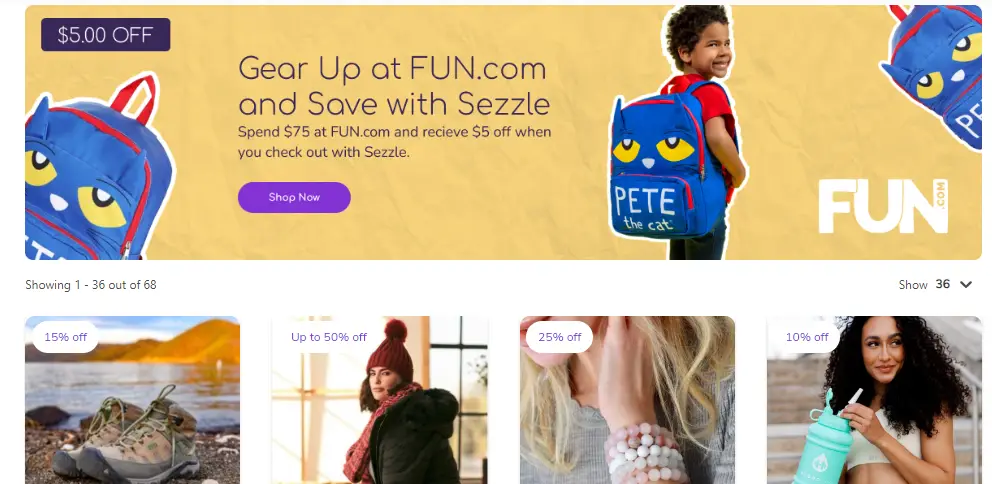

- You can use the Sezzle app’s top features to pay for a product later. You can choose Sezzle as a payment method on the product website or app. To complete the purchase, you must make the first payment instantly while purchasing.

- With Sezzle after pay, you can pay the product’s price in four installments without incurring interest. All installments must be paid within six weeks. You get a zero percent interest rate whenever you pay all the installments within time. Penalties may apply if payments are missed.

- The Sezzle app connects to more than 29,000 brands. Jewelry, apparel, footwear, and more are available to its consumers. Retailers can accept payments for products from the brands registered with Sezzle.

- Sizzle’s home screen features a category of featured stores. A shortlist of shops is selected based on reputation, promotions, and product quality. Several retailers selling a range of goods are likely to be highlighted.

The pros and cons are as follows:

The Pros are:

- There is no need for credit cards

- Zero percent interest rate

- Every order is entitled to one complimentary rescheduling

- You can check out in a flash

The cons are:

- We require an instant 25% payment

- The rewards are limited or unavailable

- A $10 late fee applies to missed prices

Final Word

With Sezzle, you can get a loan for personal and business use. This app can help you get a loan, so don’t miss out.

Compare the rates and terms of payment with other online loan providers.

You only need to worry about the regular payments you make to your loan accounts. Furthermore, you can quickly get back the money you borrowed if you need it in the future.

FAQs

Does Sezzle have a referral program?

You will receive 10% of the fees a merchant pays Sezzle during their first year, in addition to the payouts you already receive! Yes, that’s right!

What is the highest Sezzle limit?

Your account’s payment methods. We can better understand your repayment ability if you add another debit card or credit card! There is a $2500 limit on Sezzle. You may not qualify for the full $2500 if you’re a first-time user of Sezzle.

How do I give a friend a referral code?

To access your Friend List, tap the Friends tab at the top of the screen. Click the Invite button. Send an invitation with your referral code by selecting Share Referral Code from your phone’s share menu.