Investment can be a dreadful task for many of us who aren’t financially literate. Acorn serves as a bridge to reduce the gap through a revolutionary mobile app. The app was created to reduce the mind blocks and anxiety about becoming a regular investor.

Acorn Investing app that helps you save your spare change from your spending. You remember the habit of saving your change and accumulating it to make a bigger purchase. Acorn simply works on the same model by investing your change in different investment portfolios.

Investment in this app is quite simple and removes the stress of being an investor. You don’t have to be a professional investor to start your investment with Acorn.

So let us understand more about Acorn Investing App. How does it work and how you can earn money through Acorn?

What is Acorn Investing App?

Acorn is an app that has modernized the practice of saving your change to make bigger purchases. It is Robo-advisor and simply eliminates human interaction. You have to link your debit or credit card to the app, and the spare amount keeps accumulating.

If you are someone who is keen to start investing with little money, Acorn is the right platform to start. There are no criteria for minimum balance and easy to use features for beginners.

Acorns offer you three levels of membership –

- Lite – The cost of this membership is $1 per month, which is an investment account.

- Personal – The price of this membership is $3 per month, which offers you a personal and retirement account with a checking account.

- Family – For $5 per month, Acorn family membership offers you kids account with retirement and checking accounts.

How does Acorn work?

Let us, deep-dive, into the process of investing and earning through Acorn.

Acorns offer you two ways to invest – Acorns invest and Acorns later.

- Acorns investing is an automated way to start investing your spare change. Just set up your account and add money to your diversified portfolio.

- Acorns later help you save money for your retirement. Based on the IRA plan recommended by the app, start saving to meet your retirement goals.

You don’t have to panic about creating your portfolio with Acorns. Just specify your financial goals. Based on your financial goals Acorns will suggest a combination of ETFs to create your portfolio. Isn’t it interesting? Right.

Acorns will place you under any one pre-built portfolio categorized as – Conservative, Moderately Conservative, Moderate, Moderately Aggressive, Aggressive, etc.

Investments can be made daily, weekly and monthly basis. You can even make lump sum investments with a minimum of $5. Investments are made with roundups. To invest through roundups, you just need to link your debit or credit card to the Acorns app.

What is roundup?

Every time you purchase with the Acorn linked card, the company will round up the money to the nearest dollar. Later the difference is withdrawn from your account and invested in diversified portfolios.

For instance – An purchase of $11.75 is using Acorns linked card. The company will round up the purchase to the nearest dollar, which is $12. Withdraw the difference of $0.25 and investment in the portfolio.

The amount might be small, but the idea is to use the spare money and accumulate it to keep growing.

Note – You can link as many debit or credit card to your account.

Acorns also offer you a checking account and debit card composed of tungsten metal in partnership with the Lincoln savings account. Acorn checking account helps you with real-time investments and roundups.

The option of checking account and debit card is only available when you opt for Acorns spend account.

Benefits of Acorns spend account.

Wondering why opening Acorns spend account is worth it? Let us look at the features offered by the Spend account and decide if one should opt for it or not.

As stated, Acorns spend the only checking account with the debit card, which invests every time you swipe. Here are a series of features offered under Acorns spend account –

- Debit card: Debit card made up of tungsten metal is designed to look and feel good as it works.

- Ease & access: Free bank-to-bank transfers with no overdraft or minimum balance fees with over 55,000 fee-free ATMs nationwide and worldwide.

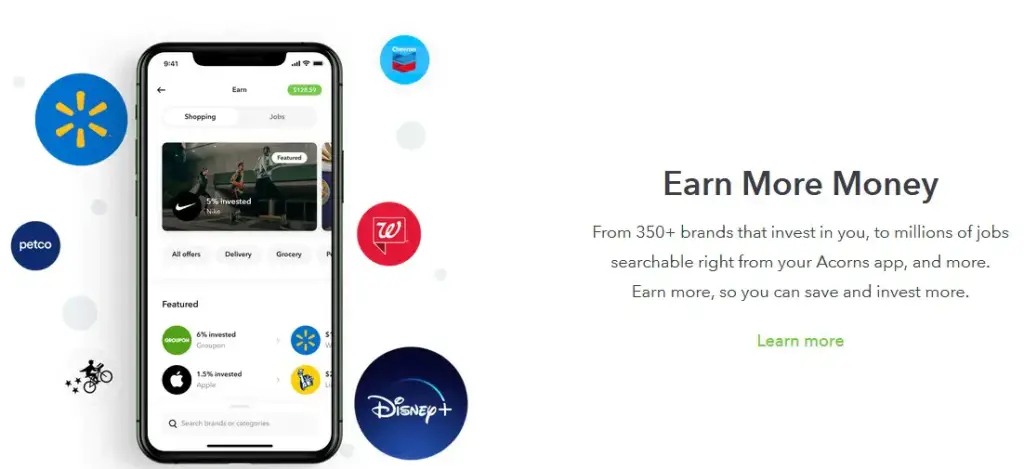

- Earn more money: All the Found Money that comes with Acorns Invest, plus up to 10% invested in you from local places you visit every day

- Spend strategies: Easy, smart ways to save while you spend including automatic retirement savings, personalized strategies, and more.

- Direct deposit: Makes digital direct deposit, Round-Ups invested in real-time, mobile check deposit and check to send

- Grow your knowledge: From quick tips to original content, grow your money knowledge as you go

- Protection: Acorns Spend, your checking account, is FDIC-insured to $250,000, plus fraud protection and all-digital card lock.

How to Create an Acorns Account

Creating an Acorns investment account is an easy process, and you can sign up using the web or downloading the app for free from iTunes, Amazon, or Google Play. The app is available for iPhone or Android mobile devices.

There are three steps to create your account with acorns that start with entering a PIN access code, which you will use when you log into the app. Creating an Acorns account is currently available only to U.S. citizens.

1. Choose a Roundup Account

Your Roundup account is one that you want to add with the app, choose the option of transactions you want to round up and invest the change. Choose from the most popular banks, including Chase, BoA, Citibank, Wells Fargo, U.S. Bank, USAA, etc. If your bank isn’t listed, click the “Next” button and type your bank’s name in the search bar.

Then you’ll see a log option. Login into your bank using your credentials. Next, click the account you’d like to use in your roundups. You can connect more than one account if you’d prefer.

2. Connect Your Checking Account

There’s a difference between the roundup account and the checking account. The checking account is the one from which funds will be transferred into your Acorns account. Connect an existing checking account from the list and sign in using your online credentials, or input your routing and account numbers manually from a different bank.

It will take some minutes for your Bank account to sync using your online ID and password. Don’t worry about the security of connecting your banking information, because Acorns encrypts and protects all of the data with bank-level security.

3. Create an Investment Account

You’ll be asked to type in your first and last names, phone number, and birth date and choose a security question/answer. Then it’s time to fill in your address and check if you’re a U.S. citizen or not.

Next, you’ll be asked to answer three questions:

- Are you or have you been affiliated with a broker-dealer?

- Has the IRS notified you of being subject to backup withholding?

- Are you a 10% shareholder of a publicly-traded company?

If none of these apply to you, leave them unchecked. These are standard questions required by the SEC when you open any brokerage account.

The next screen will prompt you to fill in your employment information, net worth, yearly income, and your investing reasons. The answers to these questions will help Acorns generate customized advice and a recommended portfolio created by its team of experts, including a Nobel Prize-winning economist.

You can choose from five different reasons for investing:

- Long-term investment

- Short-term investment

- Major purchase

- Children

- General

Finally, you need to fill in your Social Security number, which, according to the app, is used for ID verification, tax reporting, and fraud prevention.

Once you check all the signup boxes in green, click the “Get Started!” button.

Conclusion

Now you don’t have to stress about your saving with Acorns. Acorns is an automatic saving option that adds any extra change for every purchase you make.

You just have to link your debit and credit card. Tada. You are ready to go. Every time you make a purchase from the account linked with the app, it will automatically withdraw the nearest dollar and invest it.

You don’t have to learn much about the investment to start with Acorns. With the help of checking account, you can track your real-time roundups and investment made. Simple right?

Frequently Asked Questions

Do you have to pay taxes on acorns?

Yes, you have to pay taxes on any dividends you earn. The dividend is the sum that you receive for holding a stock or fund on a certain date. Acorns automatically reinvest those for you, but you may still owe taxes on them.

Do acorns affect credit scores?

No, Acorns do not impact your credit score. In case you use Acorns debit card, and somehow overdraw the account, and fail to pay the amount due, they might turn the account over to collections. However, avoiding payment with Acorns does not impact your credit score.

How do I withdraw money from Acorns?

Sign in to your account via your Android or iOS device.

Select on the following option t (Invest or Later)

Choose the “Withdraw” option.

Enter the dollar amount you would like to withdraw.

Select “Withdraw” and confirm.