Hey HelpingDesi Family????, Know How to apply for ITIN for an H4 visa for your Spouse & Kids in the USA. Steps to apply ITIN Tax Information Number USA for H4 Visa for your Family, Spouse, or Kid. This Article is on How to apply for ITIN for an H4 visa for spouses & Kids in the USA in 2022.

Before going into details about How to use ITIN? for let’s discuss more what is ITIN and who needs this.

ITINs follow a similar format as SSNs (xxx-xx-XXXX). To avoid confusion, the Social Security Administration has reserved a block of Social Security Numbers that aren’t used as ITINs rather than SSNs.

The items begin with a nine and have a 7 or 8 in the 4th position (9xx-7x-XXXX or 9xx-8x-XXXX). You can lookup ITIN numbers to see the pattern by clicking View all ITIN numbers.

- What is ITIN?

- Why does an H4 Visa holder need an ITIN number?

- When to Apply for an ITIN Number?

- How to apply ITIN with Federal Tax return (This is the easiest & best way):

- What are the documents needed to apply for an ITIN Number?

- Proof of U.S. residency is needed for dependents:

- How to get a licensed copy of Passport for ITIN?

What is ITIN?

ITIN stands for Individual Tax Information Number, i.e payer positive identification. That sounds terribly the same as a social insurance range. So yes, it is identical to SSN. The only difference is SSN will be issued for Job-holders, but ITIN is for dependent and ITIN is purely for tax purposes, even name sounds like Individual Taxpayer.

Since ITINs, like EINs, are related to Tax so it is issued by the IRS, not the SSA. FYI, SSN is issued by SSA.

ITINs are issued to folks who would like an Associate in Nursing SSN for tax functions but don’t qualify for a Social Security range. U.S. voters and legal immigrants will be given Social Security Numbers. However, even some folks who don’t qualify for Associate in Nursing SSN should have tax liabilities to the U.S. government.

During this case, the individual is also issued an ITIN for purposes of paying taxes. An IRS official website has listed the country Agent who serves ITIN service. You can see this by clicking here – IRS-authorized Certifying Acceptance Agent.

Why does an H4 Visa holder need an ITIN number?

To learn more about how to obtain an ITIN number (for H4, L2 visa, or foreign spouse), you should comprehend the reason for getting the ITIN number. It is not just an H4 Visa holder, but the dependent who is not eligible for SSN needs to have ITIN.

It helps people adjust to the U.S. tax laws, and to supply a method with efficient method and account for tax returns, payments, and refunds beneath the provisions of a U.S. tax treaty. Possessing an ITIN number is not only beneficial for Tax savings but also a necessity for U.S. tax laws, so you have to give it equal importance as an SSN (social security number).

Possessing an ITIN number can be quite an easy process. Therefore, if you’re concerned about getting an ITIN number, then you’ve got covered here.

The 30-Second Trick for How to Apply for ITIN: After receiving your W-2, You call the person who is preparing your Tax return, and they will take care of everything with nominal charges for ITIN. Please call: and refer to HelpingDesi.

When to Apply for an ITIN Number?

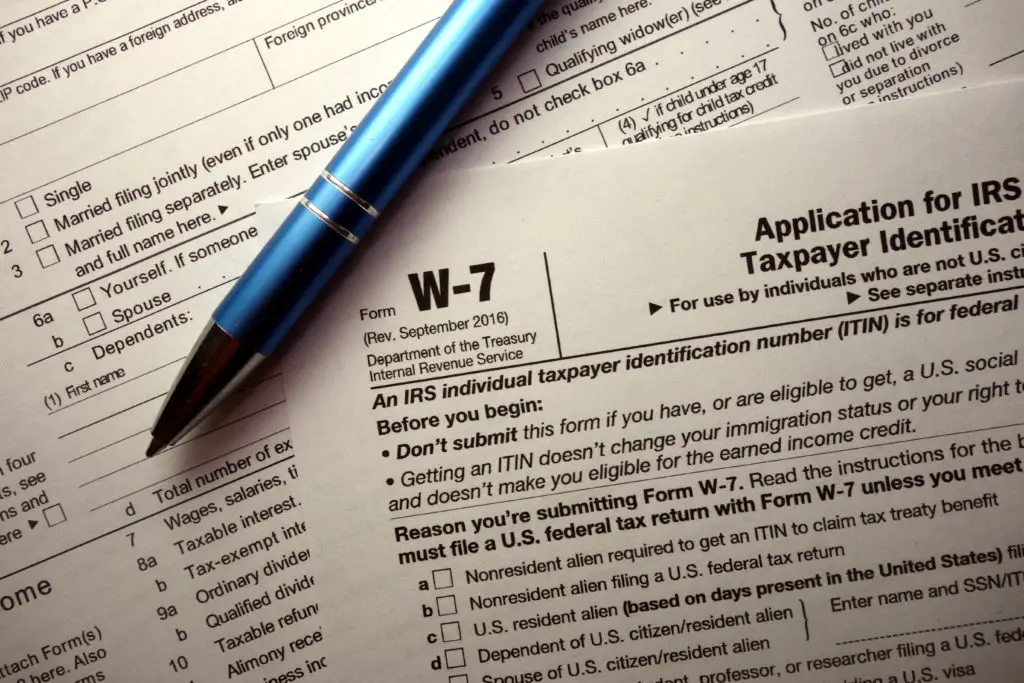

To apply for an ITIN number, H-4 visa holders should complete Form W-7, Application for IRS Individual Taxpayer Identification Number. They can submit this form along with the required documents to the IRS. The IRS will review the application and, if approved, issue an ITIN number.

You obviously can apply for an ITIN any time during the year, but ideally, people do as soon as they are ready to file a federal income tax return for a tax year usually between Jan to March.

You need to attach the ITIN application (Form W-7) along with your Federal Tax return.

How to apply ITIN with Federal Tax return (This is the easiest & best way):

When you are filing the tax return, then you can attach Form W-7, and you will get ITIN in 3-4 weeks. You also don’t have to worry about how to fill W-7 form. Your CPA or the person who is helping you with the Tax file can help you fill out W-7 either for free or very nominal charges. I am also attaching a sample that will give you a brief info on how to file W-7. Keep reading the below para.

“Apply for Associate in Nursing ITIN in-person victimization the services of an IRS-authorized Certifying Acceptance Agent. this can forestall you from having to mail your proof of identity and foreign standing documents like a Passport etc. Therefore I powerfully advise you to go to in-person if this center is close by. “

What are the documents needed to apply for an ITIN Number?

Whether you are applying for ITIN advance, or with tax filing, you need the same document, and you have to follow the same procedure. Below are the documents required for applying for ITIN:

Form W7

The ITIN form name is named kind W-7, which may be downloaded from the authority website together with the directions on a way to fill out the shape. you wish to submit a W-7 for every ITIN you apply for, (In my case, I crammed one W-7 for my relative and one for my child). There are different choices accessible to settle on for the rationale of applying ITIN, for my relative, it had been for my baby. For tax functions, a relative isn’t thought to be dependent.

Federal Taxation Return

Your original, valid tax return(s) that the ITIN is required. we have a tendency not to e-file the official document if we are applying for ITIN. Attach kind W-7 to the front of your valid Federal taxation (Form 1040, Form 1040A, associated kind 1040EZ) unless you qualify for an exception (see page three of kind W-7). you will use TurboTax or alternative free e-software to fill your come, leave the SSN section blank (for whom you’re applying ITIN), fill your come, and print it out.

As you may be filing your official document as an associate attachment to your ITIN application, you ought to NOT mail your back to the address listed within the kind 1040, 1040A, or 1040EZ directions. Instead, send your official document, kind W-7, and proof of identity documents to the address listed within the kind W-7 directions at Taxation Service, capital of Texas Service Center, ITIN Operation, P.O. Box 149342, Austin, Texas 78714-9342.

Always keep a replica of your file, and you don’t have to be compelled to offer come envelope for causation back original documents. candidates are permitted to incorporate a paid mail or traveler envelope for quicker delivery of their papers. The authority can then come to the documents within the envelope provided by someone

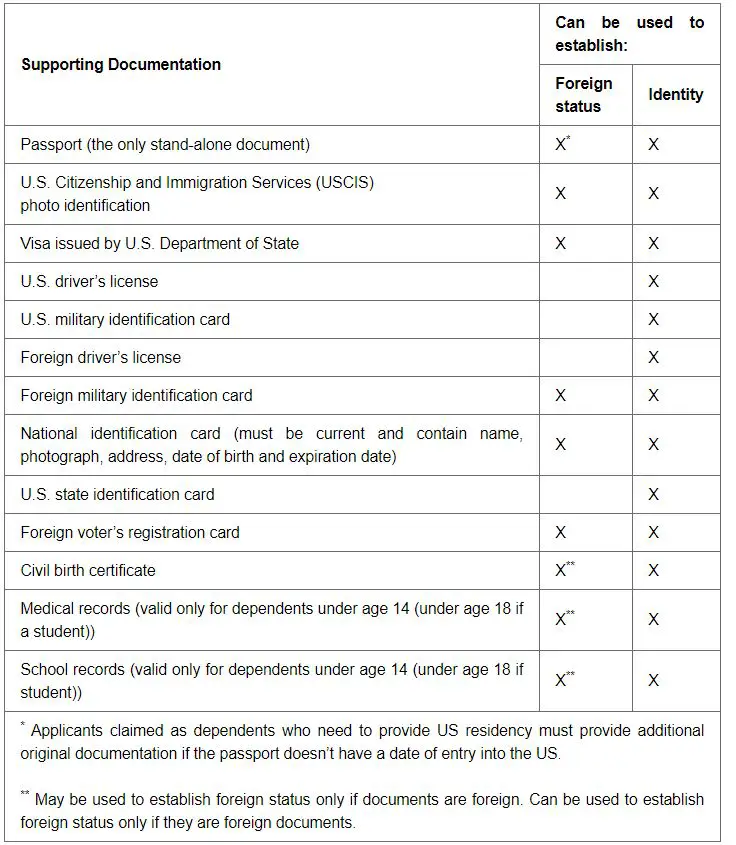

Supporting Documents for Tax Filing

You would like to supply either the first papers or certified copies of them to determine your identity and your association with an overseas country (“foreign status”) and support the knowledge provided on the shape W-7. The documents ought to be accepted as proof of identity and international standing.

*What could a Certified document mean: a licensed document is one that the first issuance agency provides and certifies as a definite copy of the original document and contains an officer-sealed seal from the agency.

An original and valid passport is the sole document accepted as proof of identity and foreign standing. If you are doing not would like to supply your Passport (or a certified copy of a legitimate passport) or it’s untouchable, you want to submit any two of the subsequent twelve documents (including a minimum of one identification with a pic and one identification from your country):

National identification card (must show pic, name, current address, date of birth, and expiration date), U.S. driver’s license, foreign driver’s license, U.S. state identification card, Foreign voter’s registration card, U.S. military identification card, Foreign military identification card, Visa issued by U.S. Department of State, U.S. Citizenship and Immigration Services (USCIS) pic identification, Civil credentials (for dependents beneath eighteen years solely unless you submit a passport), Medical records (dependents beneath age six only) and college records (dependents under fourteen years and/or students under eighteen years only). All documents ought to be the latest except credentials because it doesn’t expire.

Proof of U.S. residency is needed for dependents:

Effective Gregorian calendar month one, 2016, the IRS can now not settle for passports that don’t have a date of entry into the U.S.A as a complete identification document unless the dependents are from North American country, Canada, or dependents of U.S. military personnel stationed overseas. Thus, currently, we tend to need to submit one among the subsequent documents looking on dependent age:

If beneath six years of age: A U.S. anamnesis that lists the applicant’s name and U.S. address.

If beneath eighteen years of age: A U.S. faculty record that lists the applicant’s name and U.S. address.

If eighteen years mature or older: U.S. faculty records, rental statement, utility bill, or financial statement that lists the applicant’s name and U.S. address.

Certification of Supporting documents: in line with revised rule 2013, applications for ITIN, should embrace original documentation or certified copies of those documents. The certification had done by the issuing agency or U.S. embassy or the diplomatic building. Notarized or Apostilled copies of documentation are no longer accepted.

How to get a licensed copy of Passport for ITIN?

You can get his home country administrative unit (issuing authority of the document, that within the case of a passport is the embassy of the country that issued it) to endorse the passport photocopy.

- The other sensible choice for certification offered to those not in the U.S. (like back in their motherland country) is to travel to the U.S. Embassy or one among the U.S. diplomatic building offices. This certification is appreciated and IRS itself accepted this certification. But, the U.S. embassy is often set within the country’s capital town solely, and not all of the smaller cities have a U.S. diplomatic building workplace.

What is ITIN?

ITIN stands for Individual Tax Information Number, i.e payer identification. That sounds the same as a social insurance range. So yes, it is identical to SSN. The only difference is SSN will be issued for Job-holders, but ITIN is for dependents and ITIN is purely for tax purposes, even name sounds like an Individual Taxpayer.

Why does an H4 Visa holder need an ITIN number?

To learn more about how to obtain an ITIN number (for H4, L2 visa, or foreign spouse), you should comprehend the reason for getting the ITIN number. It is not just an H4 Visa holder, but the dependent who is not eligible for SSN needs to have ITIN.

You can read more about How to apply for ITIN by visiting the IRS official site.

Click Here For Discounted Offer

Join and Watch IPL 2024 Live

Thanks! You have successfully subscribed!!