Are you traveling to the USA as H1, H4, L1 Visa holders or a student or a short-term visa visitor? Have you or your friend ever found it challenging to choose the best credit card when you are new to a country? You may wonder how will you get credit cards for a bad credit score, no credit score or credit cards for fair credit.

Are you looking for help regarding choosing, handling, and dealing with credit cards while traveling abroad? How to overcome the issue of handling credit cards? Then spare some time and read this article till the end as it will help you in sorting out many of your problems.

Best Credit Cards for 2023: Reviews, offers, Benefits, and Usage

Like many other issues, we face while moving abroad is the problem of carrying hard cash with us. It is never advisable to take a massive amount of money with you while traveling, keeping in view security issues and governmental policies. Then what should be done? That’s where the credit cards serve as a purpose.

New To Credit Card? Here’s to keep things in mind before to Open Credit Card:

You might hear that Credit History plays a vital role in the United States. Having an established credit history and building a strong credit score will help you in various aspects whether to finance the purchase of a home or car loan or for opening a credit card account. Your credit score sometimes might be a big factor when applying to rent an apartment, requesting utility services or purchasing insurance.

Unfortunately, those who are new to credit, including young adults and recent immigrants, can find it quite challenging to establish their credit history and that is what HelpingDesi is here to help you with building a solid Credit History.

Getting Started on Opening Credit Cards:

Everyone knows What Is a Credit Card: A credit card is a payment card that stores payment in it through banking transactions and helps the user to pay the cash to the merchants for goods and services. Once decided to keep the credit cards, the next step is to plan or do thorough research to know which credit cards are the best ones. That is the credit card with countless benefits and having an excellent user experience. With help of these benefits, you can secure your retirement savings .

Here you find a list of some of the best credit cards used in general around the world. These are the ones that not only provide countless benefits but also have a great user experience. As per the latest reports and research, the following is a list of five credit cards that have gained prime importance in terms of their benefits and excellent user experience.

Best Credit Cards for Non-immigrants & Visa holders (Earn up to $5000)

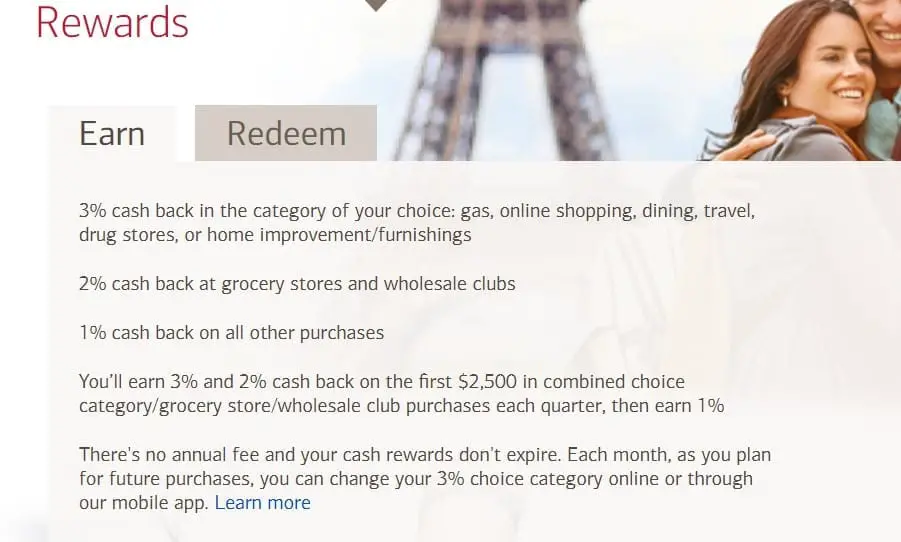

1. Bank of America Cash Rewards:

Earning: $200 cash rewards bonus (+$300 coupons for an opening checking account): $200 Bonuses after making at least $1,000 in purchases in the first 90 days of account opening. Now you may not have the plan to spend $1000 in the first 90 days but you will definitely going to buy things more than $1000 in a year. You know what I did, I bought Walmart and various other gift cards and kept in secured place (you can also open Walmart account and reload the gift card there) because Gift card never expires and spending quality money was never a problem for me. This credit card you will find most of Desi folks.

Imp Tricks:

1. You know if you are not having Bank of America Checking accounts then you will get the coupon in the next 3-6 months for opening checking account and receive $300. See image below:

2. Also if you redeem $200 in checking account then you will get additional 20% to 75% that is almost $250+ bonuses.

3. You can again open this card in 12 to 24 months interval to avail same benefits. I opened 3 cash rewards account and opted 3% in different choice categories to get maximum savings.

Get even more rewards:Preferred Rewards members earn 25%-75% more cash back on every purchase.

That means the 3% choice category could go up to 5.25% and the 2% at grocery stores and wholesale clubs could go up to 3.5%, for the first $2,500 in combined choice category/grocery store/wholesale club. Please click here to read more.

Bank of America Credit card compare features & Benefits

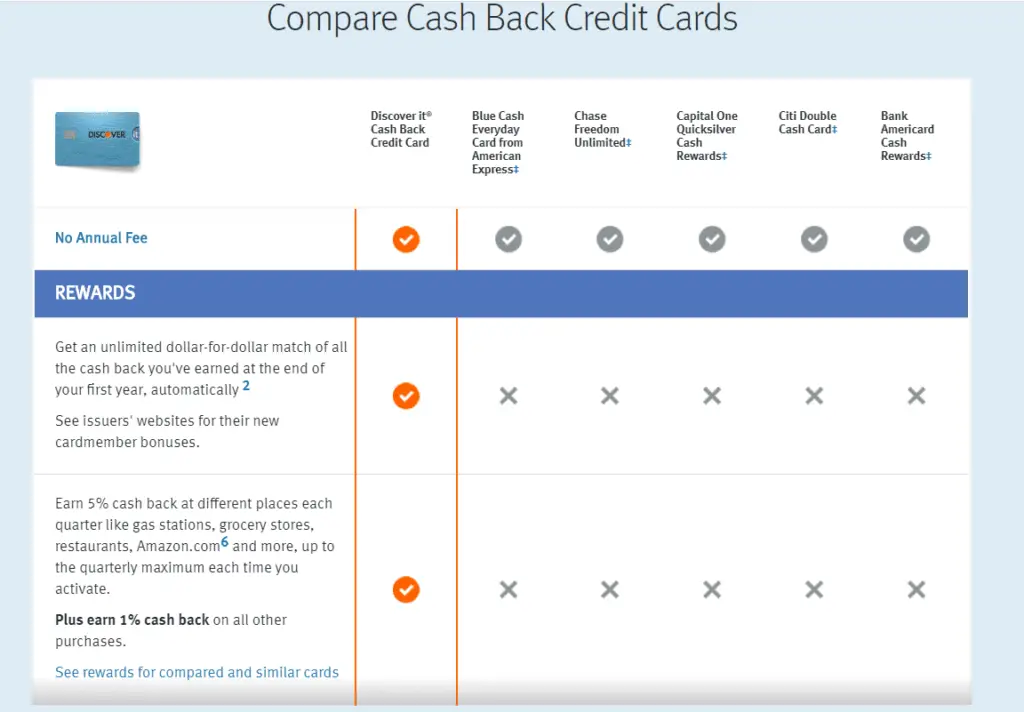

- Discover it® Cash Back

Discover card is very famous among students and Desis. It is trying to a be a different kind of credit card company, with unique benefits:

1. Enjoy 5% Cash Back

Earn 5% cash back at different places each quarter like gas stations, grocery stores, restaurants, Amazon.com6 and more, up to the quarterly maximum, each time you activate. Plus, earn unlimited 1% cash back on all other purchases — automatically.

2.Cashback Match

They’ll automatically match all the cash back you’ve earned at the end of your first year. There’s no signing up. And no limit to how much They’ll match. I purchased Costco Gift card (Costco accepts discover card for Online but not in Costco store) when they had 5% wholesale club discounts and you know what, they matched at the end of year so I got 10% as cashback on Costco gift card. It is Unbelievable discount- Only less than 1% population of USA avail discount like this and maximizing their savings.

3.Redeem Cash back or rewards with extra benefits:

Your cash back never expires. Redeem your rewards in any amount, at any time. If you redeem in Gift card you may get 20-30% extra discounts.

4. Freeze it™ option if your card is misplaced or lost:

Everyone’s had the experience of misplacing their credit card. Sometimes you leave it at a restaurant, while other times it can slip out of your wallet. With most credit cards, you’re supposed to immediately call the bank, report it lost, and have it replaced but Discover Freeze it feature to fetures giving extra relax where you Freeze the card and it temporarily prevent new purchases, cash advances, or balance transfers from being authorized on your account.

5. Cashback or cash at checkout with Discover Cash Over:

Extra cash from credit card? Yes you heard right Discover’s Cash Over program allows you to get cash back from Walmart, dozens of national grocery store chains, and other participating retailers when you check out without visiting an ATM. Just as you may have done with your debit card at a supermarket, when you receive cash with Discover Cash Over, you’ll pay no transaction fees, no ATM fee, and no bank fees. And most importantly, your regular purchase APR will apply to the cash you receive, so you won’t get hit with interest charges when as long as you pay your statement balance in full.

Smart Tip: If i need cash and no ATM near by, then i will visit any nearest store, do $1 shopping and take $20 Cash.

6. Price protection

In case you find a lower price on an eligible item that you bought within 90 days of purchase, Discover’s price protection policy will refund the difference, up to $500. So you can keep searching for bargains even after you’ve made your purchase.

7. Free FICO® credit scores

More and more credit cards are offering some kind of credit score on your statement, but Discover it® cards go beyond just printing a number on your statement. It offers a genuine FICO® score based on your TransUnion credit report. As many as 90 percent of top lenders in the U.S. use FICO® Credit Scores to help decide on your application for a car loan, credit card, or a mortgage.

In addition, Discover provides you with all of your recent scores so that you can track your history. It also tells you about the key factors behind your score. You can even find this using their mobile app.

8. Customer-friendly rates, fees, and service: Customer service are great. You just call and phone will get picked without putting you on long hold. Many card issuers seemed determined to push the limits of how many fees they can charge, Discover is taking the opposite approach. None of their cards have annual fees or foreign transaction fees. Also, Discover will automatically waive your first late payment fee, and it never imposes a penalty interest rate if you happen to pay late.

Tricks: If you get late fees even multiple times, I will suggest to call them and most of the time they will issue refund, but please don’t make this as a habit.

See how discover card is clear winner from their competitors

3. Chase Freedom® credit card

NEW CARDMEMBER OFFER: $150 bonus after you spend $500 on purchases in the first 3 months from account opening.

Earn 5% cash back: Earn cash back for every purchase Earn 5% cash back on up to $1,500 in combined purchases in bonus categories each quarter you activate and unlimited 1% cash back on all other purchases.

Smart trick: You can use perfect combination of Chase freedom and Discover card to get 5% cash back on different bonus categories.

4. Chase Sapphire Preferred® Card.

Bonus OFFER: This card has an overall rating of 4.8 on a scale of 5. It can help you to earn up to 60,000 bonus points (That’s $750 toward travel or $600 when you redeem as cash through Chase Ultimate Rewards®) once you have spent $4000 on your purchases but within the first three months of opening the account. It also provides benefits on traveling and dining out in restaurants.

Pros:

Earn 2 points per dollar on travel and dining, and 1 point per dollar on all other purchases. Airfare, hotels, cruises, taxis, rental cars and train tickets are all categorized as travel purchases. Consistent with all Chase rewards cards, you can earn unlimited points, and the points don’t expire. Points are worth 25% more when you redeem for travel through Chase’s booking tool. Or you can transfer points to several frequent traveler programs at a 1:1 rate. There’s also no foreign transaction fee — always a perk for world travelers.

Cons:

1.No Cons but you need to have good credit score.

2. The card has no annual fee first year but after that $95 year. but I have very exciting news for you, this Cons can be removed by downgrading Chase Sapphire Preferred Credit Card to Chase Sapphire Non-Preferred Credit Card. I did for myself.

5. American Express Cash Magnet® Card (Earn upto $800)

One of the Best card for Smart people and That card is Amex Cash magnet. If you want to earn $800 in short time then I have one of the best credit cards for you (in my opinion) where you are getting $250 singup-bonus by using this link (if you go without this link or by internet recommendation then you will get just $150 bonus). You can also earn $550 referral ($75 per referral by referring your friend and family). Many other awesome benefits like 1.5% cash back, 0%APR for 15 months, Amex offers (see screenshots below)

The AMEX Card is one of the best cash back card offering from American Express. If you love to travel and use your credit card frequently, the American Express Cash Magnet® Card might be for you. This card offers a lot of benefits for you.

Benefits of Amex Card

- If you can make your monthly minimum payments, American Express will not charge a penny of interest. But this is applicable on purchases or balance transfers during your first 15 months of membership.

- You’ll automatically get 5% cash back rewards on all eligible purchases.

- You’ll earn a $250 statement credit by clicking here -Get $250 when you spend $1,000 within the first three months of account opening.

- If you love to travel, you can take advantage of a complimentary rental car along with travel insurance. You also have access to the American Express Global Assist® Hotline, which offers coordination and assistance to card members traveling around the world.

- American Express offers its card members 24/7 emergency roadside assistance in the form of a tow truck or locksmith.

- Chase Freedom Unlimited® credit card:

Signup Bonus: No bonus (biggest con)

Earn 3% cash back:

on all purchases in your first year up to $20,000 spent

Cash back on every purchase

Earn up to $600 cash back. That’s 3% cash back on all purchases in your first year up to $20,000 spent. After that, earn 1.5% cash back on all purchases.* Same page link to Offer Details

APR

0% intro APR for 15 months from account opening on purchases and balance transfers.† Same page link to Pricing and Terms After that, 17.24%–25.99% variable APR.† Same page link to Pricing and Terms

Annual fee: No annual fee

Best other Credit Cards in USA

7. Costco Anywhere Visa® Card by Citi

Signup Bonus: Costco runs special offer time to time so please visit Costco store and open cards there when they have an exciting bonus:

Benefits: Make every day more rewarding by earning Costco cash back rewards on every purchase anywhere Visa® is accepted. This card is good for Existing Costco members who spend a lot on dining out, travel, and gas. The Costco Anywhere Visa® Card by Citi provides 4% cash back on gas (on up to $7,000 in purchases per year), 3% back at restaurants and on travel, 2% back on Costco purchases, and finally 1% cash back on everything else. In the categories where it earns more than 1%, the Costco credit card produces far better returns than most credit cards. The 4% rewards rate on gas is enough to make it one of the best credit cards for gas purchases.

8. Capital One® Venture® Rewards Credit Card

This card has an overall rating of 4.9 on a scale of 5. It can help you to cater a bonus of 50,000 miles in case you spend $3000 on purchases within three months from the date of opening the account. This card was named as the ‘Best Travel Card’ by CNBC in 2018

9. Ink Business Preferred Credit Card

This card has an overall rating of 4.8 on a scale of 5. It can help you to earn up to 80,000 bonus points once you have spent $5000 on your purchases but within the first three months of opening the account. The card is among widely used credit cards all over the world.

10. MasterCard® Gold Card

The master gold card is made from 24K-Gold-Plated Carbon. Its benefits include providing double points when redeemed for airfare and a $200 air annual airline credit. It also offers $100 global entry application fee credit.

11. MasterCard® Black Card

This card offers the benefit to receive a $100 annual airline and $100 global Entry application credit to its holders. Apart from this, it also provides luxury gifts from brands throughout the year.

Best Credit Cards for International Students

Well, the credit cards discussed above are the best cards overall with countless benefits and rewards. But as it is said to gain something you have to spend something. Many of these cards do have a subscription fee, as well as an annual renewal fee. As a businessman, you might afford these expenditures, but what if you are a student?

We all know that once you travel abroad as a student, you do not have enough money to spend. So how can you pay a subscription fee or renewal fee annually for these credit cards? To overcome this problem, we advise the students to go through the following cards as they are beneficial for them:

1. Citi ThankYou Preferred Card

This card is among one of the better cards, especially if you are a student in the USA. It does not have an annual fee and can lead to earning 2500 bonus points if you spend $500 within the first three months after opening the account.

It helps you to earn two points for every dollar spent on dining or any other entertainment. And make a point on every dollar spent on all other purchases.

2. Deserve® Edu MasterCard for Students

Deserve® Edu MasterCard is the best credit if you are studying in the US as an International student. The Deserve® Edu MasterCard does not require credit history security deposit for students. And for international students, the credit card issuer doesn’t even need a Social Security number to apply.

You don’t need to pay annual charges. It also allows you to earn 1% cashback on all purchases issued as a statement credit. The card does not have a yearly fee. The added benefit is that it does not have any foreign transaction fee.

3. Journey Student Credit Card from Capital One

This card is best for the students studying abroad. Neither has it had an annual fee nor any foreign-transaction fee. Moreover, it allows 1% cashback on all purchases. The added advantage is that you get rewarded with an extra 0.25% cash back if you make your payments on time. This card is beneficial for students in building credit. Also, it offers $0 fraud liability if your card is lost or stolen. And unlimited, free access to your credit score, which is something students are looking for to build up their score.

4. Cash Rewards Credit Card for Students

This card is the best card for the students who actually are from the US but are studying abroad. It also offers a sign-up bonus of 25,000 points in case of spending $1,000 on purchases within the initial three months after opening the account.

This card charges no foreign transaction fees. It means you can use the card overseas just as you would in the States without having to worry about an additional cost for each purchase you make.

With this card, you can earn 1.5 points for each dollar spent on all purchases. And when you book travel through the Bank of America Travel Center, you can make a higher rate of three points per $1 spent. This credit card offers an introductory 0% APR on purchases made within the first 12 billing cycles after account opening, which could help cover an emergency.

5. Discover it® Student Cash Back

Using this card, you can earn up to 5% cash back on up to $1500 in purchases each quarter from specific categories, e.g., grocery stores, gas stations, etc. The categories rotate after three months.

Apart from this, you’ll get 1% cash back on all other purchases outside of these categories and on purchases made within the bonus categories. The added benefit is that the Discover it® Student Cash Back card also gives you $20 for every year if you maintain at least a 3.0 GPA for up to five years.

Best Credit Cards for Short-Term Visa Visitors and earn money with signup bonuses:

When you are on a short-term visit to a country, then you pay full focus on saving as much money as you can. There are some credit cards which serve as best for the persons who are on short-term visits. Let’s discuss a few of them:

1. Capital One® QuicksilverOne® Cash Rewards Credit Card

This credit card is considered the best for the people who are planning a trip abroad. The card offers 1.5% cash back on every purchase you make. The added benefit is that you may become eligible for a higher credit line. It may happen if you can make your first five monthly payments on time. The best advantage is that the card does not have any foreign transaction fee.

Though the annual fee for the card is $39, however, it can be managed by spending just $2,600 per year. Try to avoid carrying a balance on the card, so you don’t have to pay the 26.98% variable APR on purchases and balance transfers.

2. Chase Sapphire Preferred® Card

This card offers a bonus of 60,000 points if you spend $4,000 in the first ninety days as well as 2X points per dollar spent on all travel and dining at restaurants, worldwide. The added advantage is that points are worth 25% more when you redeem travel through Chase Unlimited Rewards

3. Bank of America® Travel Rewards Credit Card

This card has gained primary importance as it offers a sign-up bonus of 25,000 points on spending $1,000 in the first three months. It also provides a 10% bonus for Bank of America® checking or savings account members. Another advantage is that it does not have an annual fee.

4. Capital One® VentureOne® Rewards Credit Card

This credit card offers a one-time 50,000-mile bonus after spending $3,000 in the first three months. Along with this, it offers 2X miles earned for each dollar spent on all purchases. It does not have any annual intro fee for the first year, but it changes to $95 after the first year.

How to Earn Money through Credit Cards

The best practice is to use your credit cards wisely, consistently, and responsibly. There are certain precautions that if taken, can not only result in saving the right amount of money monthly but also generate a separate source of income for you. Read the instructions below carefully:

Build a Good Credit Score:

The convenient way to earn the most out of the credit cards is to get a credit card, then use it punctiliously and make payments on time. It will add a lot of valuable information on your credit reports, and, subsequently, a high credit score. It is not necessary to get multiple credit cards for a high credit score. You can get a high score with one credit card.

Sign-up Bonus:

Your credit card often offers a sign-up bonus provided you have a high credit score. You can earn up to $750 as a sign-up bonus depending on the service providers rules and regulations.

Cash Back Credit Cards:

Take maximum benefit of the cash back that credit that usually cards provide. It is often a minimum of 1% of the amount spent.

Invest Your Cash Back Credit

Although it seems quite fruitful to save 1% through cash backs, the ideal practice is to invest the saved amount so that it can grow more and more.

Replace Your Cash with Gift Cards

Although money is a better-looking option, it is recommended to redeem it with cash gift cards which would result in more amounts but the form of gift cards.

Sell the Awards Credit Cards Offers You

The methodology is quite simple. If your credit card company offers you a free ticket to a movie and you are not willing to go, sell that ticket to your friend.

Transfer Balance-Reduce Interest Rate

Suppose you have a balance in a credit card with a high-interest rate. What you need to do is to transfer that balance to a low-interest rate credit card. That’s how you can save hundreds of dollars by transferring that balance to a credit card with a lower interest rate. It will help you save money as you can avoid paying interest for about two years depending on the credit card you choose.